Invest in Options Strategies

Welcome to the world of strategic investing with options, where innovative strategies meet tailored risk management. Options are versatile financial instruments that can enhance the performance and resilience of your investment portfolio within our option strategies framework.

What are Options?

Options are contracts that give investors the right (but not the obligation) to buy or sell assets, such as stocks or commodities, at a predetermined price within a specified time period. This flexibility allows investors to capitalize on market opportunities and manage risk effectively.

Strategy Integration

At 0SPX, we integrate options strategies seamlessly into our investment approach. By combining hedge fund expertise with the power of options, we aim to optimize returns while carefully managing downside risks for our investors.

Key Options Strategies Unveiled

Covered Calls

Key Benefits

Income Generation:

- Collecting premiums provides additional income, which can be particularly attractive in flat or moderately rising markets.

Downside Protection:

- The income received from selling the option can offset potential declines in the asset’s price, offering some protection against losses.

Covered Puts

Key Benefits

Downside Protection:

- It limits the potential losses from owning the underlying asset, which is crucial during volatile or declining markets.

Portfolio Stability:

- Helps maintain portfolio value, providing peace of mind to investors concerned about short-term risks.

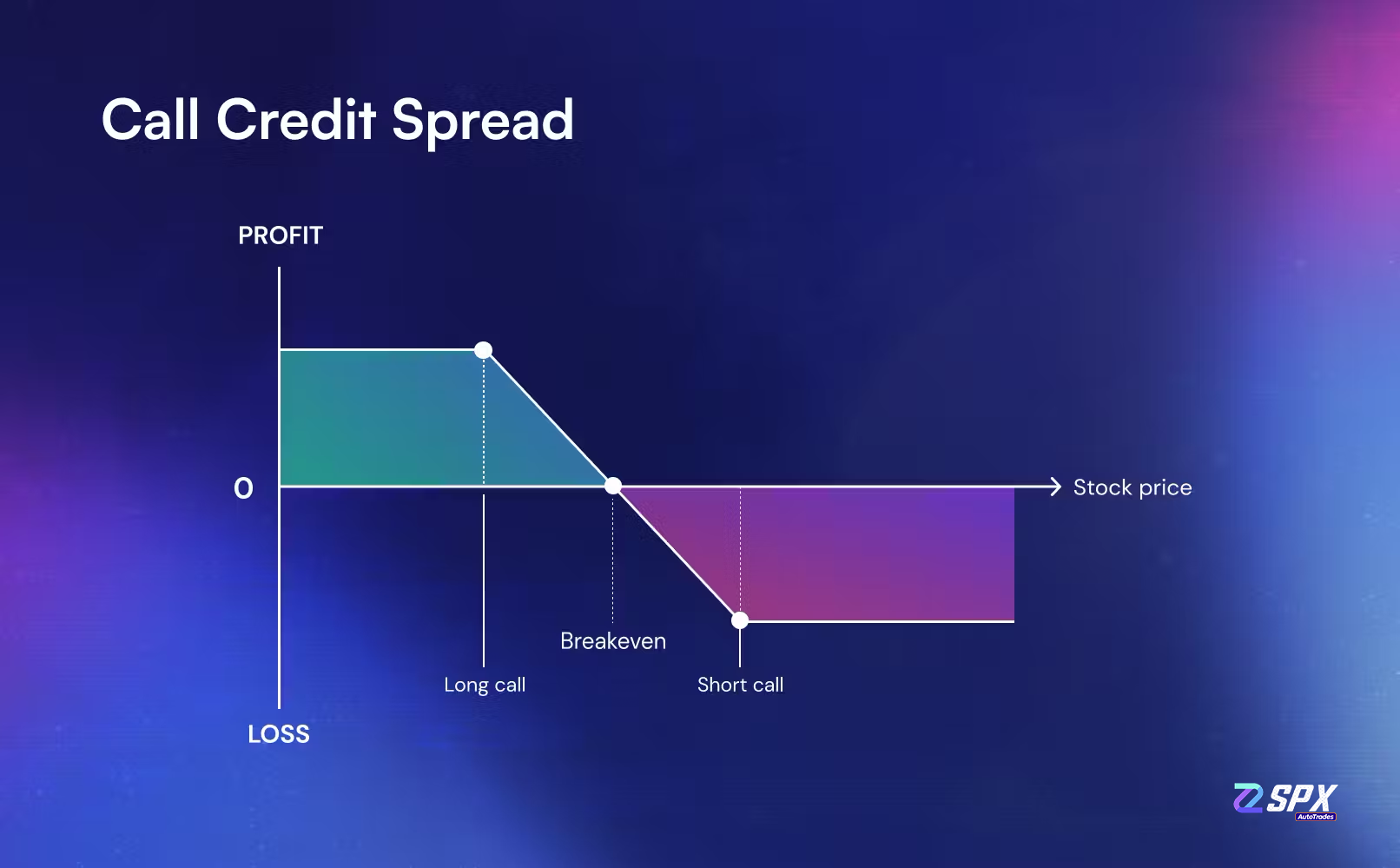

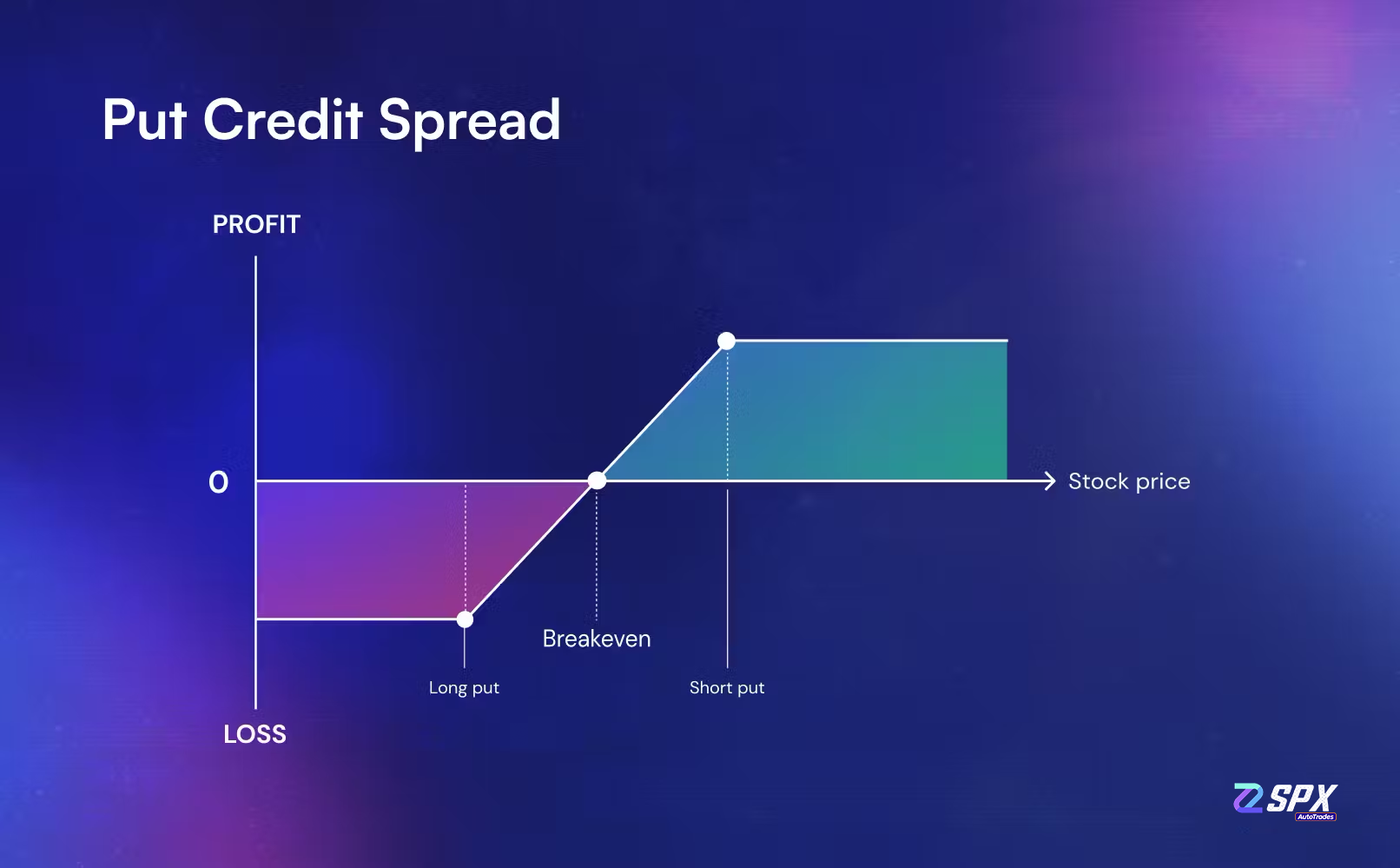

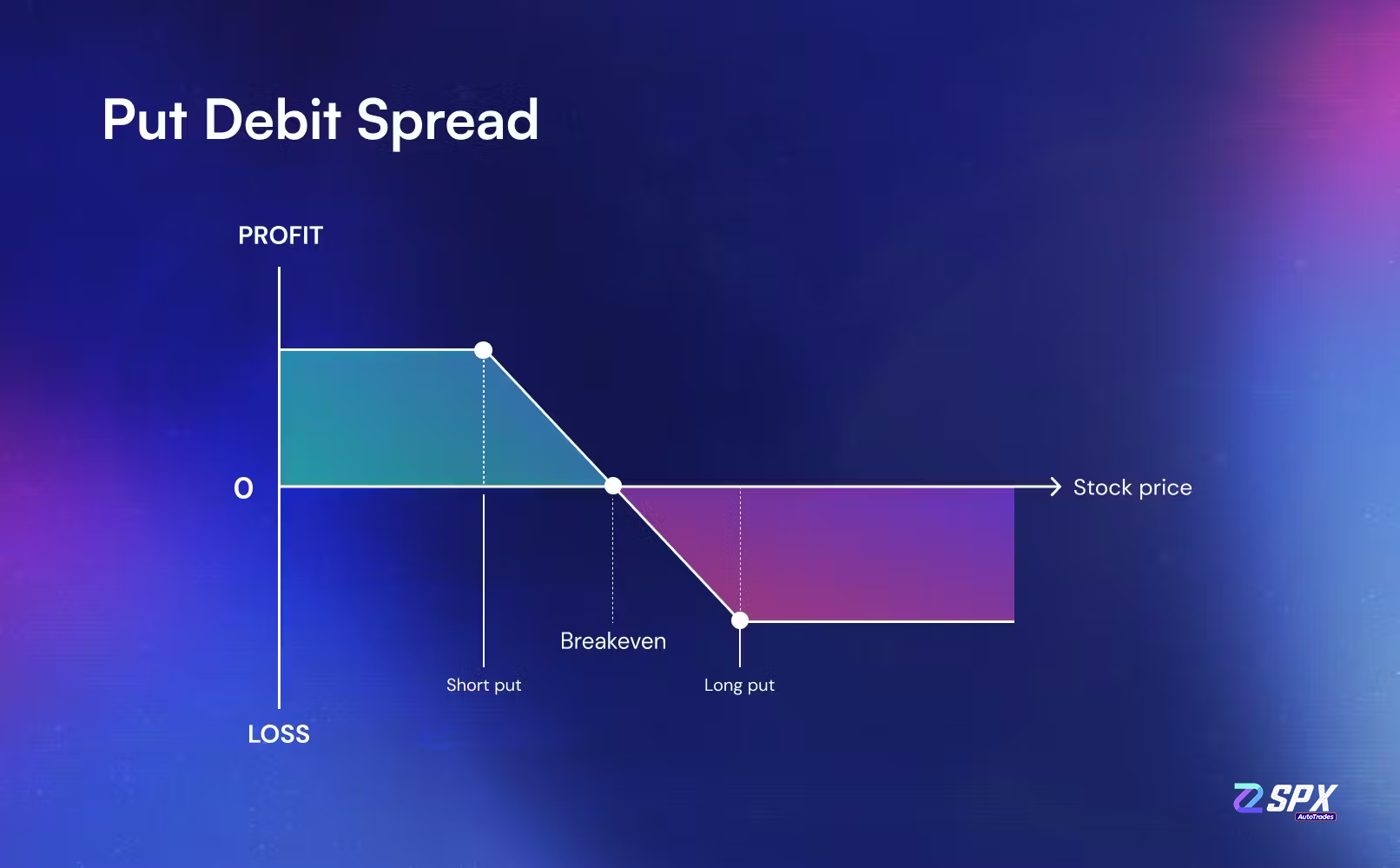

Spread Strategies

Key Benefits

Defined Risk and Reward:

- These strategies typically limit both potential loss and gain, allowing for precise control over risk exposure.

Flexibility:

- We tailor these strategies to various market outlooks, from bullish to bearish or even neutral.

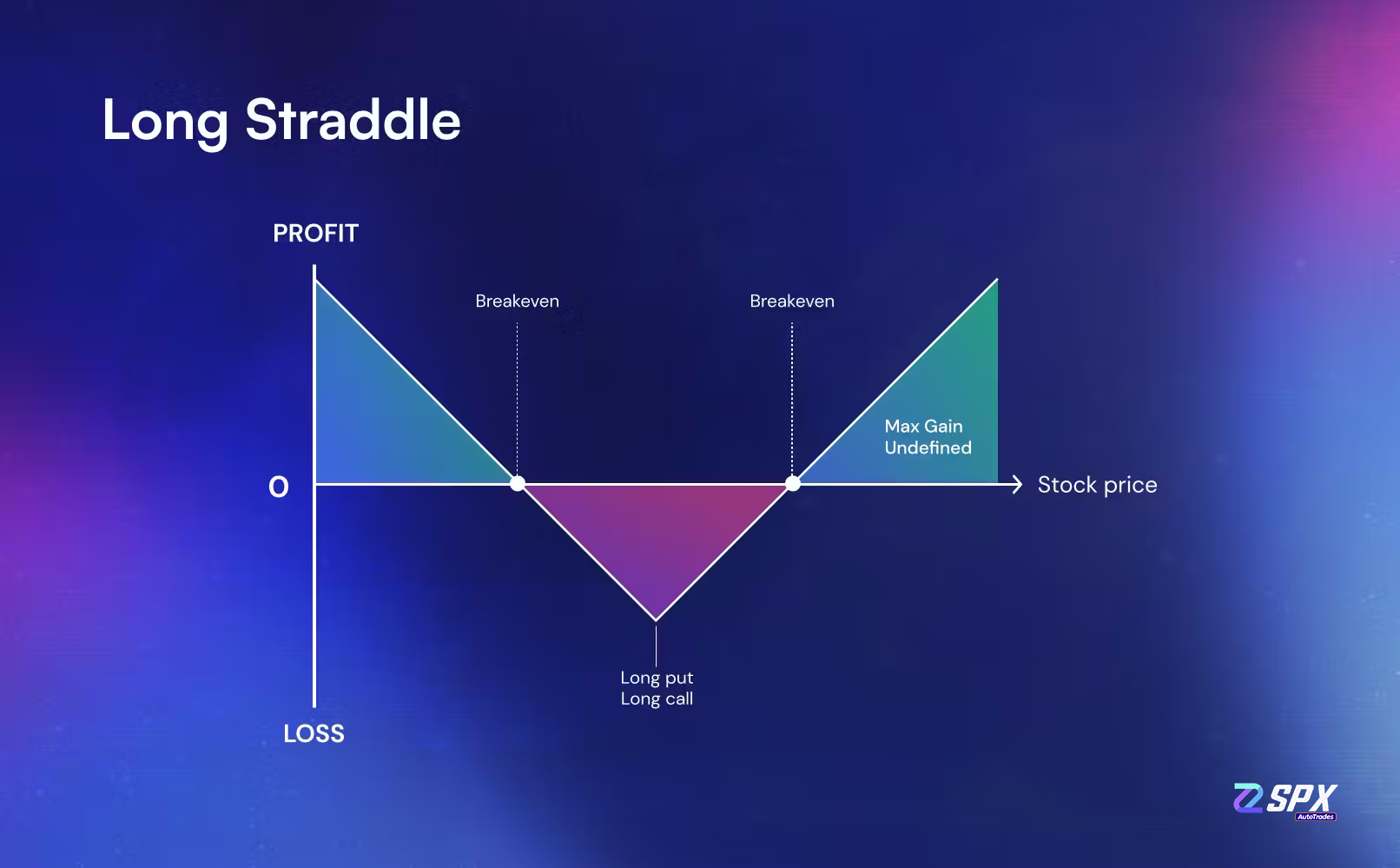

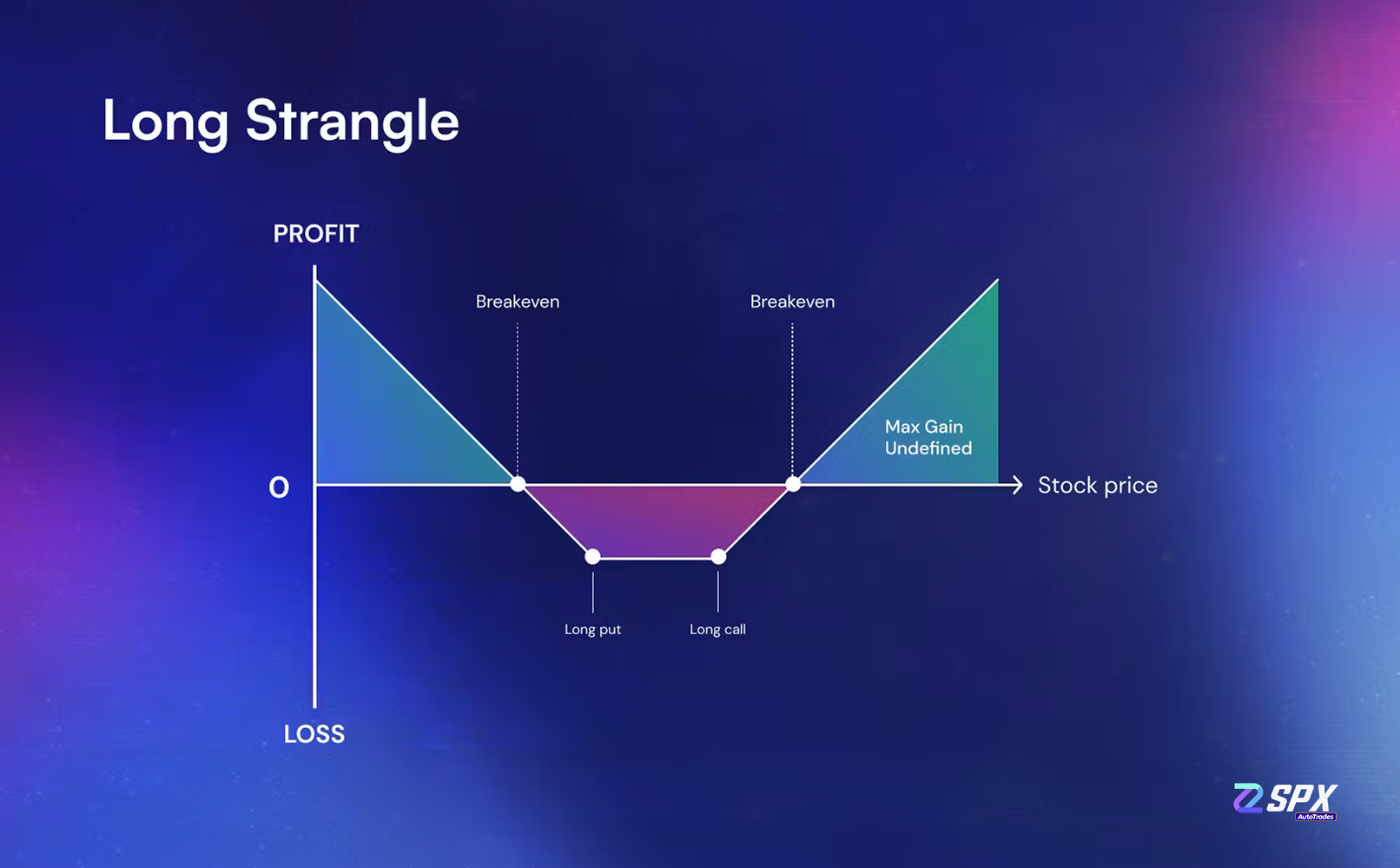

Volatility Plays

Key Benefits

High Profit Potential:

- These strategies can yield significant returns if the underlying asset moves substantially, either up or down.

Market Agnosticism:

- They are particularly useful in uncertain markets where the direction of the move is unclear but volatility is expected to increase.

Get Started In Alternative Investment In Just 3 Easy Steps

Your Common Options Questions, Answered.

- Strategic Depth: Options allow for strategic diversity, enabling our strategies to exploit a variety of market conditions and sentiments, from bullish to bearish or neutral.

- Enhanced Returns: By incorporating options, we aim to enhance potential returns through leverage, without correspondingly increasing the initial capital outlay.

- Risk Control: Options are pivotal in our risk management framework, allowing us to hedge other positions and limit downside exposure effectively.

- Our team uses options to construct asymmetric payoff structures that can lead to higher returns with controlled risks. Strategies like protective puts and covered calls are staples in managing and mitigating market volatility, aligning with our broader investment objectives.

- Understanding Risk and Reward: It’s vital to comprehend the specific risks associated with options trading, such as the potential for rapid losses and the effects of time decay on option valuations.

- Investment Goals Alignment: Investors should consider how options fit within their overall investment strategies, particularly in terms of risk tolerance and market outlook.

- Active Management Requirement: Options often require more frequent monitoring and management than other investment types, a task our hedge fund is equipped to handle.

- Options are suited for accredited investors looking for advanced investment strategies that offer high potential returns. Ideal candidates are those who are comfortable with the inherent risks and complexities of options trading and have a long-term investment perspective. Our option offerings are particularly well-equipped to serve sophisticated investors seeking diversified, actively managed strategies that aim to outperform traditional investments during various market cycles.